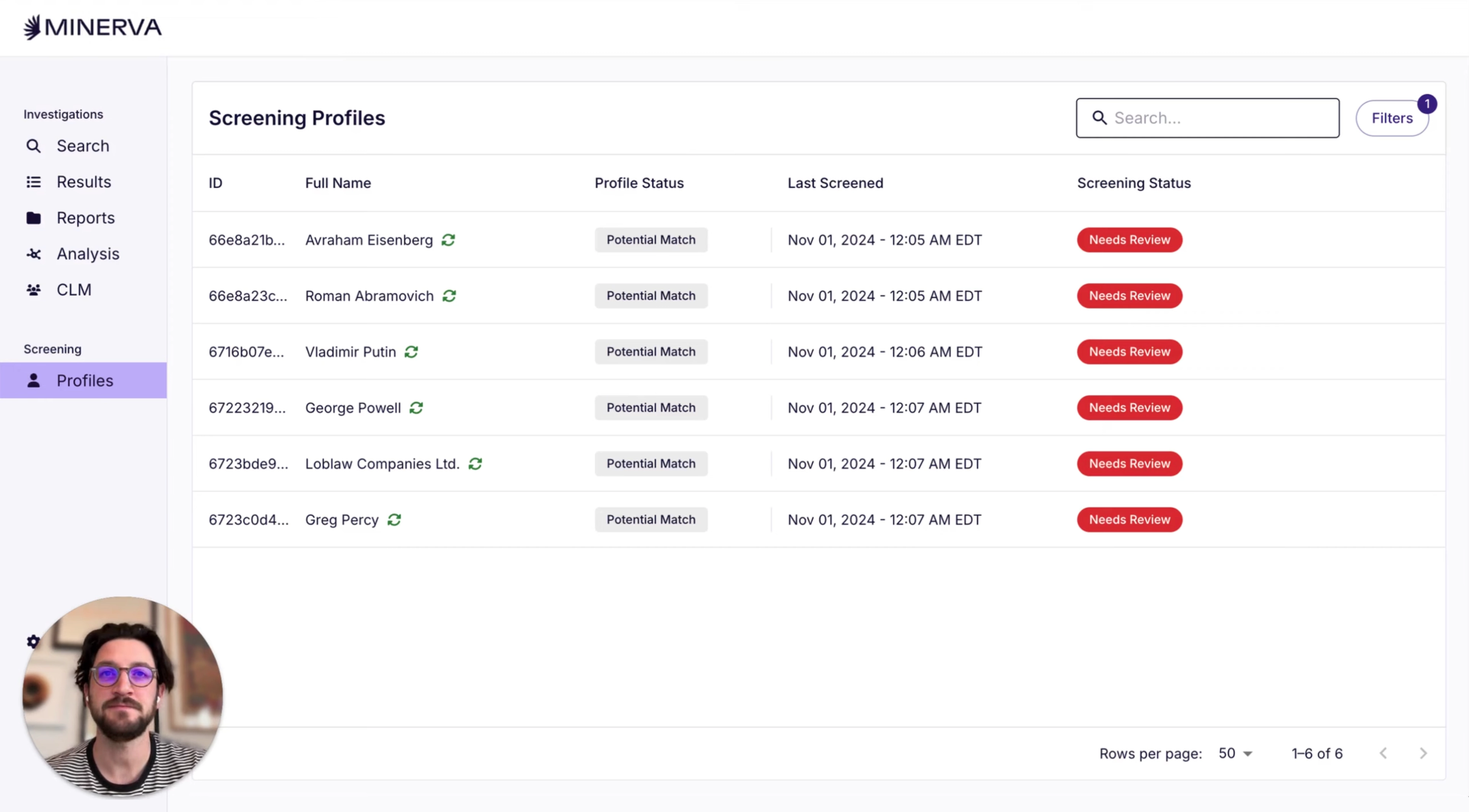

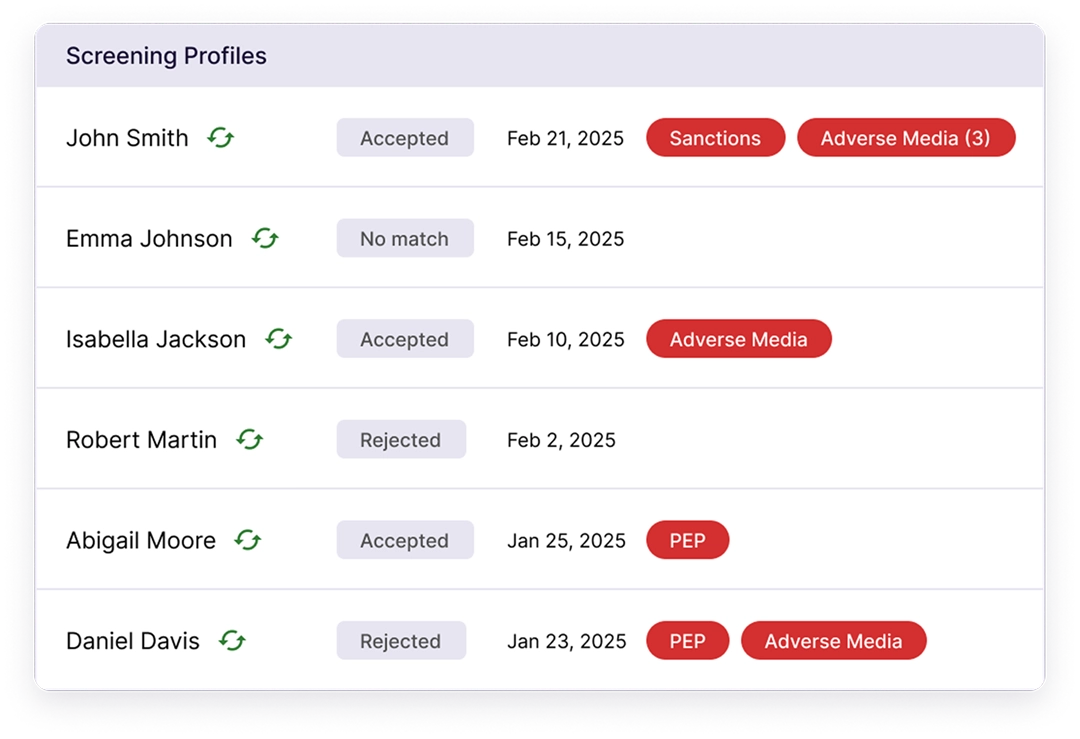

Screening Workflow

Automated screening that supports growth

Onboard up to 96% of clients automatically with Sanctions, PEPs, and Adverse Media screening that is built to scale as fast as your business does.

Leading Compliance teams Rely on Minerva

The impact of automated screening

Minerva's precise risk detection means you can confidently approve new clients without manual review, reducing friction and delighting customers.

Minerva's contextual understanding of risk delivers only meaningful alerts, so your team focuses on genuine risks and eliminates wasted efforts.

Minerva consolidates critical information automatically, enabling analysts to make informed decisions in a fraction of the time.

Gain visibility into your alerts with one shared queue

All sanctions, PEP, and adverse media alerts appear in a single, organized queue your entire team can access. Compliance managers have oversight over all alerts and can seamlessly collaborate with analysts ensuring efficient resolution and consistent decision-making across the team.

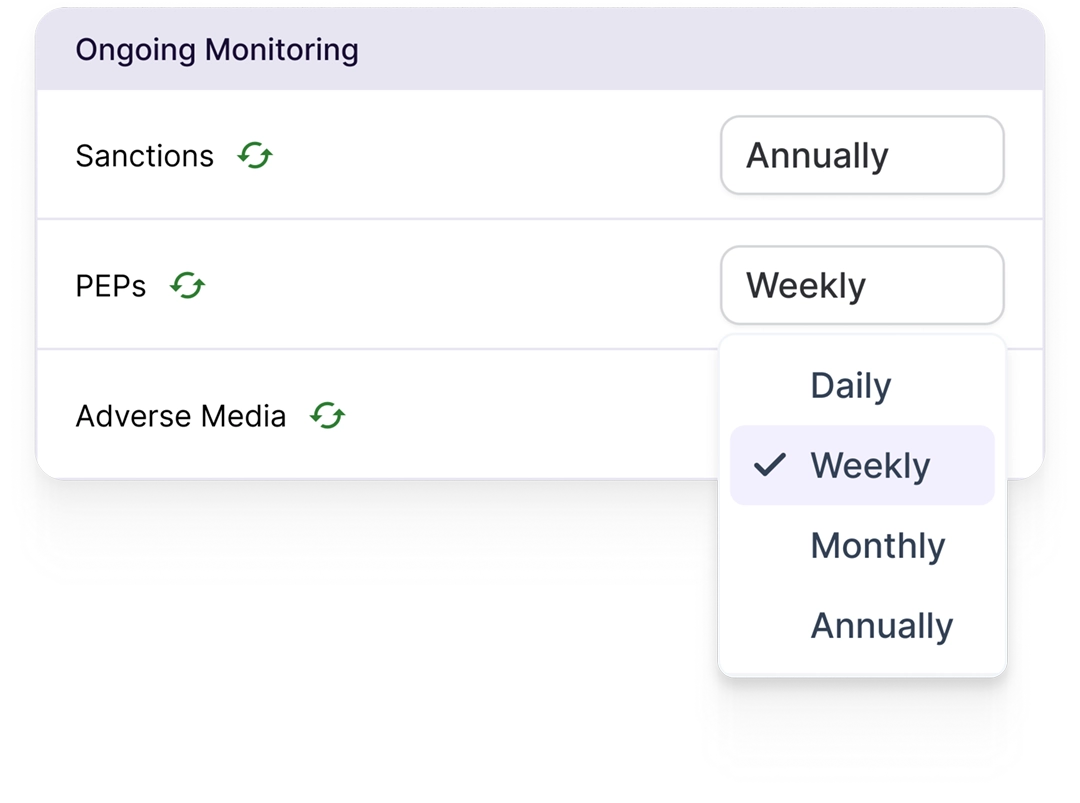

Configure ongoing monitoring to align with your AML policy

Stop worrying about monitoring deadlines. Schedule ongoing client screening at whatever cadence you need, whether weekly, monthly, or quarterly, and Minerva handles the rest.

Avoid redundant alerts with intelligent alert management

Unlike competitors that bombard you with the same alerts repeatedly, Minerva remembers your past decisions. We automatically filter out alerts on profiles you've already addressed, only notifying you when something meaningful changes.

Trusted by top compliance leaders

Frequently asked questions

Here are answers to the questions we hear most often. Still have questions? Our team is ready to walk you through everything during a quick, no-pressure demo.

Get a DemoMinerva uses AI trained on 5+ million investigation decisions to understand context like an expert would. It recognizes when variations in names, addresses, or identifiers should or shouldn't be flagged as the same entity, reducing false positives while maintaining accuracy.

Don't let compliance slow your growth

Join leading fintechs and crypto companies who are reducing false positives by 75%, eliminating repetitive manual work, and scaling compliance operations.